The Inflation Reduction Act of 2022 extended several tax credits that are designed to help businesses offset the impact of rising prices. One of the key provisions of the Act is section 25C of the federal tax code, which provides a tax credit for homeowners and businesses that invest in energy-efficient technologies and practices. In this blog post, we’ll take a closer look at section 25C and outline the steps you (or your customers) can take to take advantage of this tax credit.

- Understand the requirements: To be eligible for the tax credit outlined in section 25C, you must meet certain requirements. For example, the tax credit is only available for improvements made to existing buildings, not new construction. In addition, the improvements must be made to the building’s envelope (e.g., walls, roof, windows, etc.) or to certain systems within the building (e.g., heating and cooling systems, hot water systems, etc.). It’s important to carefully review the requirements to ensure that your business is eligible for the tax credit.

- Determine which improvements qualify: There are several different types of improvements that may qualify for the tax credit outlined in section 25C. These include things like insulation, windows, doors, and roofing materials. And yes, this includes any Accufoam® product installed in 2022 or beyond. It’s important to carefully review the list of qualifying improvements to determine which ones are applicable to your business or customer’s homes.

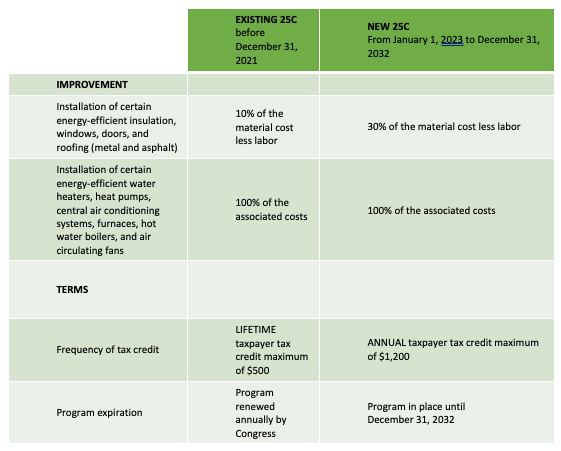

- Calculate the credit amount: The amount of the tax credits you’re eligible for will depend on the type and cost of the improvements made. The credit is typically calculated as a percentage of the cost of the improvements, with higher percentages available for more energy-efficient technologies. For example, the credit may be 30% of the cost of insulation improvements, but 50% of the cost of windows or doors. It’s important to carefully calculate the credit amount to ensure that you receive the maximum benefit. See the chart below:

For Accufoam® products you can claim 30% up to a maximum of $1200.00 credit (not including labor)

- File the appropriate forms: To claim the tax credit outlined in section 25C, claimants will need to file the appropriate forms with the IRS. This typically includes Form 5695, which is used to claim energy-related tax credits. In addition to Form 5695, tax filers may need to provide additional documentation, such as receipts for the improvements made.

- Keep good records: It’s important to keep good records of the improvements made and the associated costs. This will make it easier to claim the tax credit and will also help to ensure that your business receives the maximum benefit.

In conclusion, section 25C of the federal tax code provides a valuable tax credit for businesses and homeowners that invest in energy-efficient technologies and practices. By understanding the requirements, determining which improvements qualify, calculating the credit amount, and filing the appropriate forms, you can take advantage of this tax credit and save money on your tax bill.